Meta stock value has gone up 21.7%. It gained over $200 billion and set the record for the biggest one-day percentage rise in a year today after it declared its first dividend results.

In the coming of Facebook’s 20th anniversary, Meta closed an additional $50 billion in repurchasing of shares and said its quarterly dividend would be; 50 cents, a share.

It is the first company to issue a dividend, and the fourth of the so-called “Magnificent Seven” stocks, producing 0.5% equaling Apple, according to LSEG data.

The returning of cash to shareholders is a bold and well-regarded move. The amount of free cash pumping through the business means it is more than able to afford it, and it helps pay investors for their patience,”

Sophie Lund-Yates, lead equity analyst said

This would be a monstrous bag ($175 million) for Mark every quarter. He owns about 350 million Meta Class A and Class B shares.

Meta’s strategy of announcing buybacks and dividends right before the Fed begins to cut rates is a brilliant move. As the battle for innovation grows … in the Big Tech space, investors will see any extra capital as dry powder for future earnings growth,”

Thomas Monteiro, analyst said

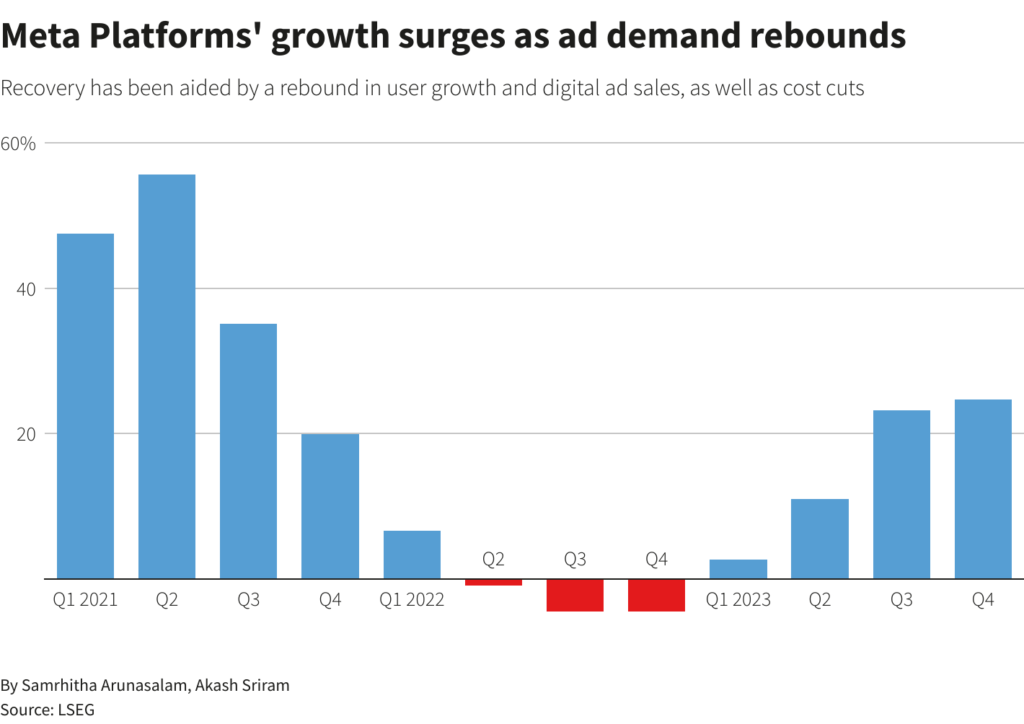

The company suspended ad sales and rebound in user growth during its fourth-quarter results on Thursday saw its revenue increased by 25% surpassing analyst’s estimation.

That jump in quarterly revenue, combined with an 8% drop in costs and expenses after eliminating over 21,000 jobs since late 2022, allowed Meta to triple its net income to $14.02 billion.

The ‘Year of Efficiency’ has paid off with both headcount and costs dropping, and Meta exceeding our expectations for full-year 2023 ad revenue,”

Jasmine Enberg, principal analyst at Insider Intelligence said

The biggest social media company in the world has been spending heavily over the years to boost its computing capabilities and capacity for generative AI products. It adds to Facebook, Instagram and WhatsApp, and hardware devices such as its Ray-Ban smart glasses.

Meta’s shares recently traded at 21 times expected earnings, compared with a forward PE of 84 for smaller social media rival Snap (SNAP.N), 20 for Alphabet (GOOGL.O), 41 for Amazon.com (AMZN.O), 32 for Microsoft (MSFT.O), and 27.36 for Apple.